Section 179 business income limitation calculation

The tax application calculates the amount of aggregate trade of business income by totaling the following amounts. The Section 179 deduction limit for 2022 was raised to 1080000 with an equipment spending cap of 2700000.

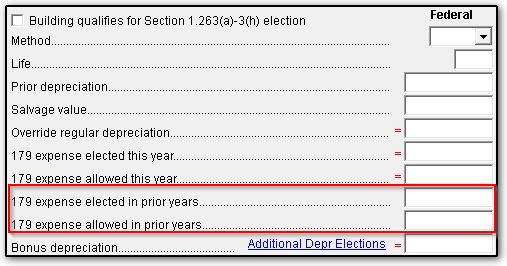

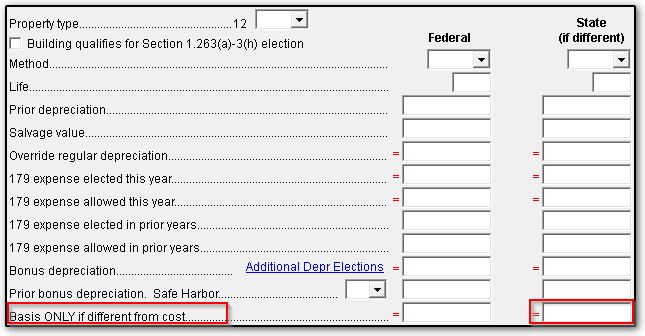

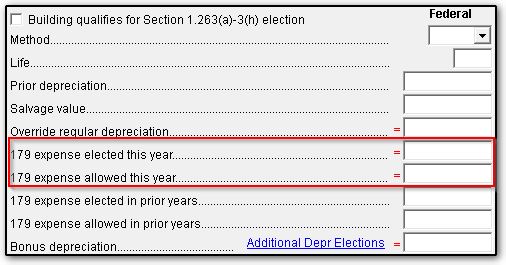

4562 Section 179 Data Entry

Also the maximum section 179.

. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. A partnership for federal income tax purposes9 The LLC commenced operations on September 1 1994 and purchased Section 179 property placing same in service during the 1994. The maximum Section 179 deduction is 1040000 and the beginning phaseout of the deduction is 2590000.

The tax application calculates the amount of aggregate trade of business income by totaling the following amounts. This is a slight increase from the 2021 Section 179 tax deduction which. If the amount on Form 4562 line 11 is less than the amount on line 5 UltraTax CS prints a not required statement for S Corporation clients detailing the amounts that are used to calculate.

The dollar limitation for their joint income tax return is 7000 the lesser of the dollar limitation 10000 or the aggregate cost elected to be expensed under section 179 on their separate. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Example Calculation Using the Section 179 Calculator.

For example if your business purchases. However if you spend more than 2620000 on qualifying property your deduction will be reduced on a dollar-for-dollar basis. The section 179 dollar and investment limitations are applied at the partner and partnership level.

At this level Section 179 is limited to the amount of taxable income from all businesses in which the taxpayer has an interest. Select section 1. Section 179 business income limitations are as follows.

Wages Household income Not reported on Form W-2 from the Other. Section 179 deduction dollar limits. This limit is reduced by the amount by which the cost of.

An individuals W-2 income is considered to. The total amount that can be written off in Year 2020 can not be more than 1040000. You are considered to actively conduct a trade or.

In a tax year beginning in 2018 the total of all section 179 deduction. Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000.

Under tax reform if you buy equipment for your business you may be able to benefit from an almost doubling of the amount you can expense from the 2017 Section 179 amount of. Wages Household income Not reported on Form W-2 from the Other. There is also a limit to the total amount of the equipment purchased in one year.

You can deduct up to 1 million of qualified expenses per year purchased and placed in service for your business in 2018 and following tax years. How do I adjust business income for the section 179 limitation using worksheet view in Individual tax. Companies can deduct the full price of qualified equipment purchases up to.

In other words as long as your. The total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. Since your Section 179 deduction would reduce your profit from 20000 to 10000 you are entitled to take the full Section 179 deduction of 10000.

What Is Irs Section 179 And How Can It Help Small Businesses

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Section 179 Expensing Block Advisors

K 1 Income For Self Employed Blueprint

How To Complete Form 1120s Schedule K 1 With Sample

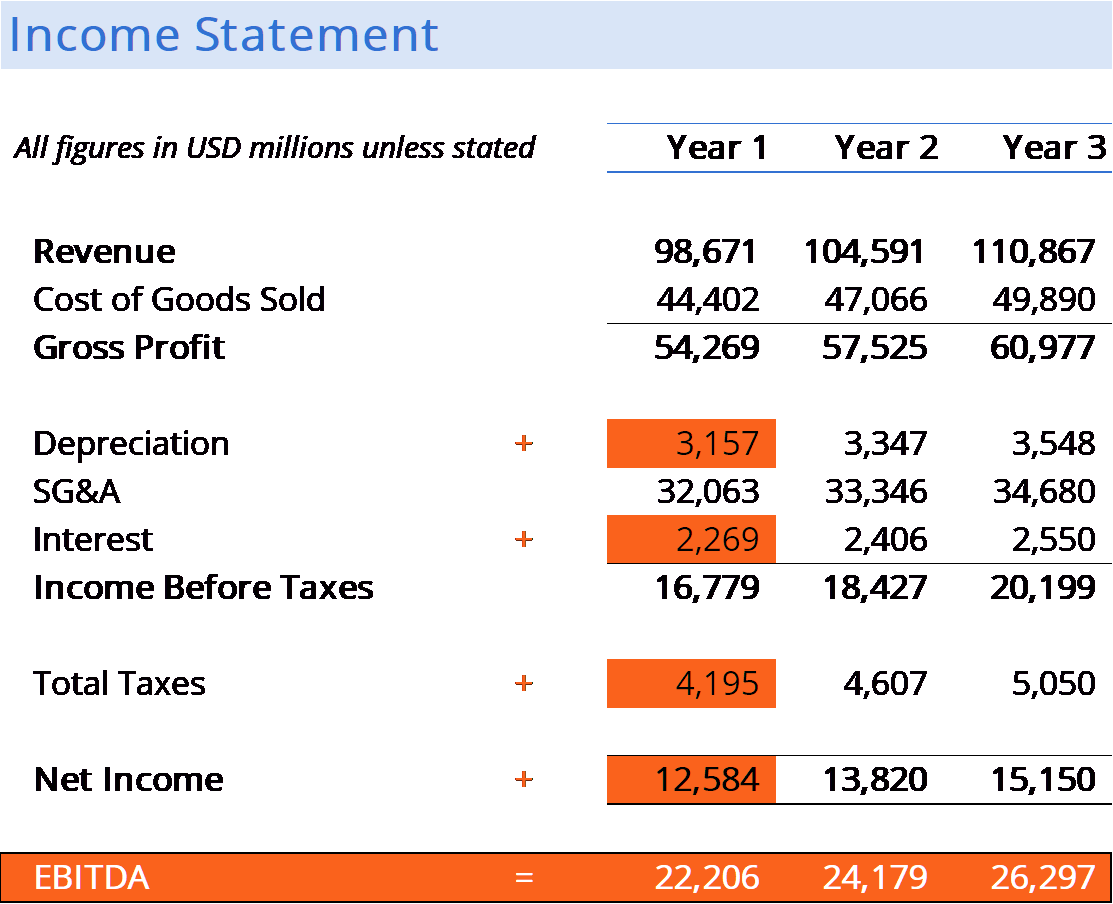

What Is Ebitda Formula Definition And Explanation

Things You Should Know About Tax Write Offs In Canada Fbc

Section 179 Definition

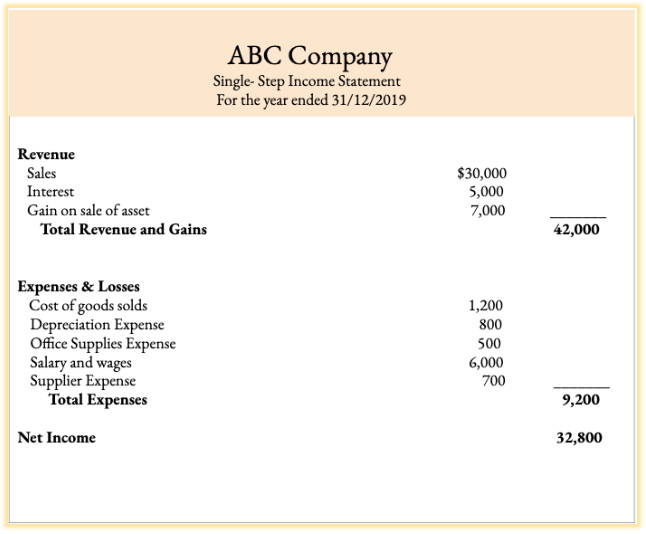

Complete Guide To Income Statements Examples And Templates

Improving Pathology And Laboratory Medicine In Low Income And Middle Income Countries Roadmap To Solutions The Lancet

4562 Section 179 Data Entry

/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition

Section 179 Expensing Block Advisors

4562 Section 179 Data Entry

3vgovtymdnkksm

4562 Section 179 Data Entry